Time Value of Money & Why You Should Invest

- Kristine Beese

- Mar 14, 2021

- 5 min read

Now that we've done a rundown on RRSPs and TFSAs, let's delve into the time value of money and why you should be investing your money! 💰

What is the time value of money (aka: inflation)?

One of the most important concepts about money is the Time Value of Money. Sounds super fancy right?

Actually, you probably already know what it is intuitively. 'Time Value of Money' is a fancy term that describes how the value of what you can buy for $1, changes over time. You might know it by another name... Inflation!

Inflation describes how things get more expensive over time. 📈

For example: you probably noticed that the cost of clothes, haircuts, and bills, etc., all go up over time. But if you look at this another way, you could also say that the amount you can buy with a dollar goes down over time. What you can buy for $20 goes down over time 📉 (cue Gen X saying: "it costs HOW MUCH?").

Unfortunately, this also means that when you save money, the value of your savings (what you can buy with that money) goes down over time. Inflation is one reason why investing your money is so important (but we'll talk about investing in more detail down below).

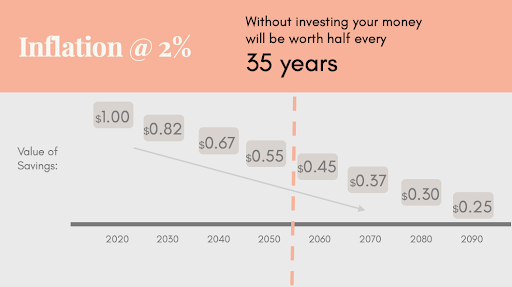

Let's look at this another way: with a 2% annual inflation rate, your money is worth half of its value every 35 years.

We use 2% annual inflation because this is what the Bank of Canada targets - which we can get into if you're interested.

And just in case you didn't already know: inflation is actually different from year to year. Over the past 10 years, inflation has averaged out to be around 2% per year, which is a reasonable expectation to hold for the future.

How do I prevent my savings from losing value?

Now that we’ve learned about inflation (which erodes your savings), what can you do about that?

Simple - you invest your money. Just to stay on even ground, you need to invest your money in something that gives you more than a 2% annual return on your money.

Not only can investing help you stay ahead of inflation, if you invest and get higher than 2% in a compound annual return, then you are getting your money to work for you. Your invested money is earning money and this can help you reach your other big financial goals -- such as buying a house or a car, starting a business, putting children through school and many other big purchases you may make in your lifetime.

Most importantly, investing is beneficial for saving for retirement. For most people, the main reason they invest their money is to save for retirement. And the earlier that you contribute, the more likely you’ll meet your retirement goals.

What is the difference between saving and investing?

Investing and saving your money are often used interchangeably, but as we’ve seen above, they are actually very, very different.

Let’s take a closer look:

Example: If in 2010, I put $1 year into a savings account (top - reference image), like you have at a bank (with 0% interest, because that’s what banks are paying these days)

And I also invested another $1 into an investment account (bottom - reference image) and invested into a diversified ETF that earns a 4% compounded return.

This chart shows what things will look like every 10 years. After 70 years in a savings account, you’ve saved 70 dollars putting your money in the bank. But in the bottom where you get 4% compounded return you’ll have $364.

It is very hard to save your way to a desirable retirement. You really want your money invested in a financial product that will give you a return on your investment. This is what people mean when they say “getting your money to work for you”.

Don’t forget: Even in the above example, inflation is dragging the value of the money down! So even though you would have $364 if you invested your money over 60 years, that $364 would allow you to buy FEWER goods in 2080 than it would today.

When should I start investing my money?

If you haven’t already, you should start today! It is never too late to start investing, but the earlier the better! Time is your biggest advantage when it comes to investing.

Remember, if I invest $100 at 25, it could turn into $1000 by 65, and if I invest the same $100 at 45 in the same scenario, it turns into $300 by 65. This is the power of time and investing. It is your biggest advantage.

(This assumes a 6.1% compound annual rate of return).

Why should women invest?

Women’s financial lives are significantly different than men's. We have discussed this in previous blog posts, but here's the gist:

Statistically, women tend to go into careers that pay less; we earn less for equal work; and our incomes are more likely to fluctuate. We’re more likely to take time off for elder-care responsibility or maternity leaves; and we’re more likely to work part time at some point in our lives.

We also pay more for goods and services like dry-cleaning, hair cuts and grooming products; we pay more for big ticket items like cars, and we pay higher rates for mortgages and credit cards even though we are less likely to default on our borrowings. Women also have salaries that peak around age 40, whereas men’s salaries peak around age 55. These are prime income generating years – years when men are topping up retirement funds, when they are putting money into education funds for children, or investing their money in a business.

You can see that over a lifetime, men accrue significantly more money than women do, and women don’t have the opportunity to catch up the same way that men do. This is why studies have shown that women need to save and invest the full amount of their RRSPs and their TFSAs towards retirement.

So what can women do differently? Well, we have some tips that can help you:

Start as early as possible‼️

Have a plan: know what you need and have a plan to get you there (we can help you with this here at Untangle Money)

Invest your money - don’t just put it in a high interest rate savings account!

Find a female financial coach, planner, or advisor that you like and can connect with: studies have shown that female advisors are more likely to help women achieve their financial goals

Learn enough about your money so that you know you are comfortable with your investments.

What's next?

Untangle Money's mission is to help women understand and alleviate some of these issues in order to successfully set themselves up financially. We all love being strong, independent women, and financial independence is a HUGE part of that! You can purchase our MINI to get a financial health check-up, and see how investing can make a difference for your future!

At Untangle Money we help women understand their (real!) financial picture, and obtain financial guidance from people that actually, really, get it. We would love to help you, too. Join the community of hundreds of other women looking to strengthen their financial well-being. You can get in touch here for a free consultation!

Comments